As a parent, you may shrug off the idea of having money talks with your kids and think that the time for that has not yet come. But you need to know the best time for this talk is now, right now. You may not be ready to talk money and loans with your kids, but you should know that they will learn it from someone. In such a case, why don’t you be Lendgreen, who will guide and be a positive example to your kids, someone your kid’s trust? If you have only scratched the surface with this topic, then go deeper with your kids. Below are some tips you can exercise when you want to have that successful money talk with your kids.

- Start slow

A 2017 survey done by T. Rowe Price states that up to 69% of parents usually have some reluctance, especially when it comes to having the money talk with their children. And you find that only 23% of the kids have money talks with their parents. In any case, you may be surprised at what your kids already know about money, and have it easy on what it is that remains that you need to teach. Your kids may even be more comfortable approaching you with questions about money when they see you are welcome to the topic.

- Be honest

The best thing you can do when talking money matters with your kids is, to be honest with them. In most instances, you realize that parents almost never have honest conversations with their kids about almost any sensitive information. You never know, your kids can handle it. Just open up and tell your kids the truth about your money constraints, installment loans, and financial loans and credit stresses. Your kids will appreciate your openness and learn from your experience.

- Talk values, and not figures

Your kids don’t need to know how much money you are earning or any of the other large sums you’re in control of, but about concepts like budgeting, saving, giving, and paying down debts.

- Set family goals

You can let your kids also contribute in on your family budget and committee meetings as well. You can celebrate with your kids whenever you manage to reach your financial milestones. Let your kids help you pay off your debt, just remember that you are the adult here. With all this new information, your kids will learn that sacrifices must be made if you want to achieve your goals in life.

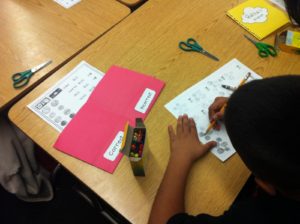

- Guide your kids through a budget

Most parents teach their kids about money by using allowances. You can kick this up a notch by also educating your kids about how to create and manage a budget for the cash you give them. Let your kids learn from you the value of a dollar, what you can buy with a dollar, and how you can save as well.

- Explain borrowing and loans

You can try to explain to your kids using simple examples that they can easily understand. For example, tell your kid that his or her friend borrows some money from him or her for lunch and promises to pay it back, the friend then returns the money with a bag of chips as a token of appreciation for the help. An example, like this relates to your kid’s environment and can easily interpret it.

- Starting early is key

The most important investment you will ever make is your child’s future. So better man up and have this talk early. You can use everyday examples that are money-related that your child easily understands.

- Learn about money together

There are topics that even you, as the parent, may not fully understand about money. You and your kid can learn these together, research the topics. This is also a great way you can spend time with your kids.